BTC Price Prediction: Consolidation Before Q4 Rally Amid Mixed Signals

#BTC

- Technical Consolidation: BTC trades near moving average with bullish MACD divergence suggesting underlying strength

- Institutional Adoption: Major banks expanding custody services and ETF offerings provide fundamental support

- Seasonal Considerations: September typically brings volatility, but analysts anticipate Q4 rally potential

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Support

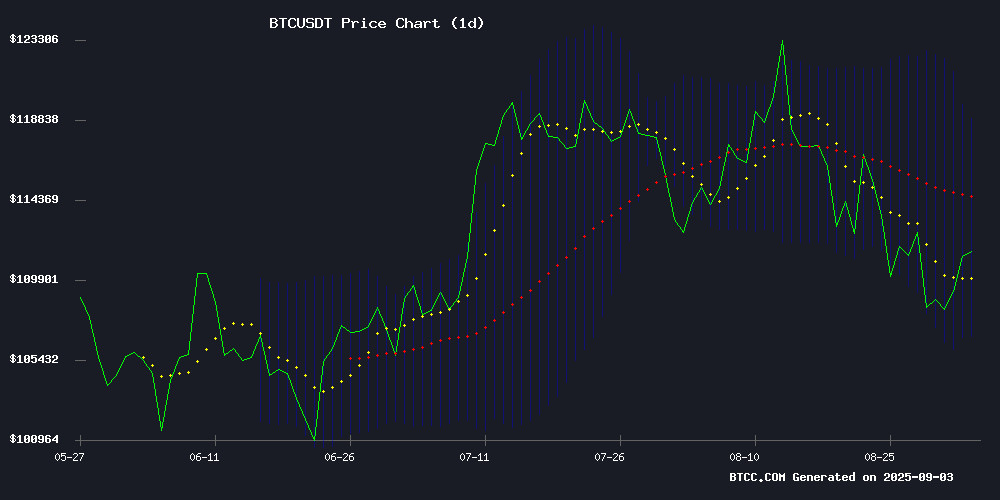

BTC is currently trading at $112,128, slightly below its 20-day moving average of $112,880, indicating potential short-term weakness. The MACD reading of 3526.70 remains above the signal line at 3320.42, suggesting underlying bullish momentum persists. According to BTCC financial analyst William, 'The price hovering NEAR the middle Bollinger Band at $112,880 shows consolidation, while the upper band at $118,942 represents immediate resistance. A break below the lower band at $106,819 could signal deeper correction.'

Market Sentiment: Institutional Developments Offset Seasonal Concerns

Recent news highlights contrasting forces affecting Bitcoin. Positive institutional developments include U.S. Bank reinstating Bitcoin custody services and expanding to Bitcoin ETFs, alongside Winklevoss-backed Treasury BV's planned Euronext Amsterdam listing. However, seasonal September concerns and analyst warnings about potential pullbacks create headwinds. BTCC financial analyst William notes, 'While institutional adoption continues to build fundamental support, traditional September volatility and derivative trader caution suggest near-term consolidation before a potential Q4 rally.'

Factors Influencing BTC's Price

Bitcoin Faces Imminent Price Drop as September’s Crypto Trends Unfold

K33 Research's latest report signals potential turbulence ahead for cryptocurrency markets, with Bitcoin (BTC) at risk of falling below $100,000. The analysis points to overlooked macroeconomic catalysts, particularly Federal Reserve policy debates, as key drivers of downward pressure. Historical data shows September averages a 4.6% decline for BTC—a trend that could spill over into altcoins.

Vetle Lunde, K33's Head of Research, characterizes current market conditions as stagnation rather than consolidation. The report emerges as BTC tests the $112,500 support level, with altcoins positioned for potentially sharper declines should Bitcoin breach psychological thresholds.

U.S. Bank Reinstates Bitcoin Custody Services, Expands to Bitcoin ETFs

U.S. Bank has relaunched its cryptocurrency custody services for institutional clients, now including Bitcoin ETFs through a partnership with NYDIG. The move follows improved regulatory clarity and rising institutional demand for digital asset solutions.

The bank initially introduced crypto custody in 2021 but paused operations in 2022 amid regulatory uncertainty. NYDIG will serve as sub-custodian, providing secure storage for Bitcoin assets. "This expansion reflects our commitment to meeting client needs in a maturing digital asset landscape," said Stephen Philipson, vice chair of U.S. Bank Wealth, Corporate, Commercial, and Institutional Banking.

The reinstated service marks a significant step in traditional finance's embrace of cryptocurrency infrastructure. Early access is currently available to Global Fund Services clients, with broader rollout expected as institutional adoption accelerates.

AI-Driven Cloud Mining Platforms Gain Traction as Bitcoin Surges Past $115,000

Bitcoin's meteoric rise above $115,000 in 2025 has reignited the crypto mining gold rush, but traditional methods remain hampered by exorbitant energy costs and infrastructure complexities. Cloud mining platforms now offer investors passive income streams without hardware headaches—though not all solutions are created equal.

AIXA Miner emerges as the industry vanguard, leveraging artificial intelligence to optimize mining efficiency and democratize access. Where legacy providers rely on static contracts, this platform dynamically allocates resources using machine learning, achieving 30% higher yields than competitors while reducing energy consumption.

The sector's evolution mirrors broader crypto maturation—what began as retail speculation now demands institutional-grade infrastructure. As proof-of-work evolves toward hybrid AI models, mining profitability increasingly hinges on algorithmic optimization rather than brute computational force.

Bitcoin Faces Downside Risks as Remittix Emerges as Top Altcoin Presale

Bitcoin's price hovers above $110,000 after a 14% correction from its $124,474 peak, with analysts flagging $108,000 as critical support. Resistance looms between $110K–$117K, and failure to breach this range could see BTC test $104K. The Relative Strength Index at 56 reflects tepid bullish momentum.

Meanwhile, Remittix, a PayFi-focused altcoin, has raised $23.4 million in its presale, selling 641 million tokens at $0.1030 each. The project is gaining traction as investors seek alternatives amid Bitcoin's uncertainty.

CryptoAppsy Enhances Real-Time Market Tracking for Digital Assets

CryptoAppsy emerges as a critical tool for cryptocurrency traders, offering instantaneous price updates and portfolio tracking without mandatory account setup. The app aggregates data across thousands of assets—from Bitcoin to emerging altcoins—with millisecond latency, leveraging robust server infrastructure to capture arbitrage opportunities and market shifts.

Historical price graphs and customizable watchlists enable data-driven strategies, while live portfolio valuation syncs with exchange rates for real-time performance assessment. The platform's cross-exchange consolidation eliminates the need to toggle between trading venues, focusing exclusively on relevant assets.

US Bancorp Relaunches Bitcoin Custody Services Following SEC Regulatory Shift

US Bancorp, the fifth-largest commercial bank in the United States, has resumed its digital asset custody services, starting with Bitcoin (BTC). The move targets institutional clients, including registered investment funds and spot Bitcoin ETF providers—a market segment experiencing rapid growth since early 2025.

The custody platform initially launched in 2021 through a partnership with fintech firm NYDIG but was suspended in 2022 after the SEC's SAB 121 required banks to list crypto holdings as liabilities. The accounting burden rendered such services prohibitively expensive. With the SEC rescinding SAB 121 in January 2025, US Bancorp has re-entered the sector at an opportune moment.

Stephen Philipson, head of US Bank’s institutional division, hinted at potential expansion to additional cryptocurrencies, contingent on internal compliance reviews. The relaunch positions US Bancorp alongside major financial institutions like BNY Mellon in building digital-asset infrastructure.

Bitcoin Derivatives Traders Show Cautious Optimism Amid September Uncertainty

Bitcoin derivatives traders are positioning for potential upside despite September's historical bearish tendencies. The cryptocurrency has gained 3% over two days, trading at $110,000, as passive buying activity drives the market rather than aggressive accumulation.

Open interest on perpetual contracts rose 2.35% to $30 billion, signaling growing trader participation. Options markets reveal bullish bets with concentrated open interest at $120,000, $130,000 and $140,000 strike prices, suggesting expectations for continued momentum.

Order book depth analysis shows increased passive bids, reflecting measured optimism. The derivatives activity contrasts with September's typical macroeconomic uncertainty, creating an unusual divergence between seasonal patterns and current market positioning.

Winklevoss-Backed Treasury BV to List Bitcoin Firm on Euronext Amsterdam

Treasury BV has secured $147 million in funding, led by Winklevoss Capital, to expand its Bitcoin holdings and establish itself as Europe's largest publicly traded Bitcoin treasury. The firm plans to acquire 1,000 BTC and will list on Euronext Amsterdam through a reverse merger with MKB Nedsense.

The deal involves MKB Nedsense issuing new shares at a 72% premium, reflecting strong institutional confidence in Bitcoin's long-term value proposition. Cameron and Tyler Winklevoss continue to demonstrate their commitment to mainstream crypto adoption through strategic investments like this.

Bitcoin Faces Potential September Pullback Before Q4 Rally, Analysts Divided

Bitcoin's post-halving cycles suggest a historical pattern of September pullbacks followed by fourth-quarter rallies. The cryptocurrency, now trading above $112,400 after recovering from last week's dip to $107,271, faces skepticism from analysts like Benjamin Cowen of ITC Crypto. He notes Bitcoin's tendency to revisit its 20-week simple moving average in September during post-halving years—a pattern observed in 2013, 2017, and 2021.

Market data confirms September declines of 7.30% in 2021 and 7.72% in 2017, with 2013 showing a 1.58% loss. Despite a current 3.66% gain for September 2025, Cowen anticipates a repeat of this cyclical behavior. Others, like Underblock CEO Vinicius Bazan, question the consistency of these patterns, suggesting potential deviations this year.

Is BTC a good investment?

Based on current technical and fundamental analysis, BTC presents a compelling investment opportunity with some near-term caution advised. The current price of $112,128 shows strength despite being slightly below the 20-day moving average. Key factors to consider:

| Metric | Current Value | Interpretation |

|---|---|---|

| Price vs 20-day MA | $112,128 vs $112,880 | Slight bearish pressure |

| MACD Signal | 3526.70 > 3320.42 | Bullish momentum intact |

| Bollinger Position | Near middle band | Neutral consolidation |

| Support Level | $106,819 (Lower Band) | Key downside protection |

William from BTCC suggests that while September may bring volatility, the institutional adoption and strong technical foundation support long-term investment viability, with any dips potentially offering accumulation opportunities.